There’s a famous Agatha Christie quote where she mentions that when she was young, she never imagined she’d be rich enough to own an automobile or poor enough to not have servants in her house. At some point, the affordability of one shot way past the other.

In my lifetime, I’ve seen huge cost increases in housing, and huge cost decreases in most technological products. When I was a kid, the normal TV size was something like 20 inches, and cost more than a month’s rent for a typical apartment. In 1990, the average rent was $447, according to this. I found a Sears catalog from 1989 with a 25 inch TV selling for $549, and a 20 inch TV for $318. It would be hard to convince someone from 1990 that one day the cheapest, shittiest apartments in the poorest neighborhoods would rent for more than a 60-inch TV per month. Or that the typical ambulance ride costs something like a month’s salary of a factory worker.

That’s the real problem with old people’s sense of money. The human tendency is to assume that all products cost the same multiple of those products prices in their early adulthood, so the luxury products of their youth remain the luxury products of today. These old people are stuck in some kind of Agatha Christie style of cost comparison, without the self awareness, and thinking that someone who owns a cell phone should be able to afford to buy a single family detached house, or couldn’t possibly be bankrupted by a single Emergency Room visit.

I totally agree with you that this is true, but I think it’s more a problem with reactionary thinking than anything else. The way I see it, the type of thinking that leads to reactionary comments is individualistic solutions to social and economic problems because you’re not allowed to question affordability.

People of all ages pull this shit. I can’t count how many times some millennial on reddit made unwanted suggestions for a poor person’s budgeting or grocery purchases. It is obviously difficult for older folks to understand things they’re not experiencing, but I don’t think that’s the primary issue.

Ask any traitor lunatic under 40 what to do about high prices, they’ll tell you exactly.

We had to give up entirely on affording a house. There are ROOMS for rent at $1200 here. This used to be a low COL area until COVID. We had low infection rates so a ton of people moved here and we don’t have the infrastructure to support them. We’ve been priced out of what living space we did have and since there’s still the illusion it’s cheap to live here, it’s almost impossible to get a living wage.

All CEOs are bastards or something

“Have you tried simply having more money?”

Life’s really easy when you’re born rich and white.

No one wants to work (for nothing) anymore!

You can’t get there buying cars and phones you can’t afford either.

As you type this, people in poverty who had their state-sponsored cheap telephones so they could get callbacks for work and take care of their families, are getting notified that the program has been canceled and they have to now somehow pay for their own phones on top of every other fee and expense that increases when you’re poor.

It’s also kind of hard to not pay for your car when you live in it. Speaking from experience.

The phone that you use every day, that is required to function in daily society, and is the NUMBER ONE priority when you’re homeless, aside from maybe obtaining legal documentation?

That cell phone?

The highest priced iPhone, all max specs, is $1600.

If you get a new one every year, and trade in the previous year’s, you’ll probably get around $600 trade in value. So we’re talking $1000/year for the highest priced phone.

On a monthly basis, we’re talking $83/month. That’s like a rounding error on rent, utilities, and food, much less transportation and health care.

And, more realistically, people are buying $800 phones once every 2 years, maybe seeing something like a $600 net expense spread over 24 months, for $25/month.

Phones are like the one thing that are cheaper in 2025 than in 1985.

Hell yeah, grind away for basic necessities. Bet you’re a dream to talk to at parties.

Nice strawman you got there, goes well with all the avocado toast I buy instead of using it for a mortgage payment.

That argument is stupid, because usually people need a reason to save for. Now rent is so high that people can barely save, and houses are so expensive that even if they do and get a credit with their staggering student debt, they’ll never be able to afford it.

So what do people do? they just enjoy the small things, because they know they’ll never have the big ones.

It’s not stupid, you’ve just stupidly misinterpreted it.

I believe you’ve mistakenly interpreted it to mean that I disagree with the premise that people have been priced out of the things we’ve come to believe are the standard of living now. That’s not what I was objecting to.

My point is that money should ALWAYS be managed. If you have no money, then, well I guess it manages itself. But if you have very little money, you shouldn’t be buying s $60k car you can’t afford. You buy a $3k car you can. Saying, I can’t afford a house so I’m going to go into massive amounts of debt to buy a car to make up for it, is the REASON you need to manage money.

No, your take is very stupid

you just avocado toast even harder. Now you not only over generalized people, and willfully ignore the cause of the problem.

You then turn items that are essential to life in society into irresponsible luxuries. If you can’t afford to rent there is no such thing as an affordable phone/car.

The point of the post is that it’s not merely impulsive spending and you went, “nah, it is just that”

Your take only gets stupider the more you try to explain it.

My point is that money should ALWAYS be managed.

Is that what you think people are talking about in here? money management?

You are truly too dense for any of this. Fortunately for you, you probably have never been touched by actual hardship and I hope that continues for you. The rest of us have had to deal with the very worst our nation can throw at us.

The Ratio says it’s actually pretty stupid. The percentage of people who can’t afford a home purely because they bought a $60k car is going to be absolutely minuscule, but it’s a great dog whistle for trying to lay the blame at the feet of personal responsibility.

It’s a whole lot more than you think.

There is no such thing as a $3k car, those days are gone. If it’s going to be something that is expected to start and drive every day without major repairs that are overdue, you need to spend closer to $10k.

I know this because I recently bought my sons some used cars. Used 2006 Volvo was $6k in about as good of condition it could be for the age and miles. Still needed a bunch of little things that quickly added up. New tires ($800), PCV breather system ($120 did myself), new ignition coils ($200, did myself), brakes ($80, did myself), etc. If I wasn’t doing my own work, it would have been 3x the cost.

I also bought a 2013, nearly identical car to the 06. It needs far less, put tires on it, still has an evaporative emissions leak causing a check engine light. Not going to fix that.

I buy $1k cars sometimes, but they usually don’t run. A $3k car will be usable if you know how to turn wrenches, have space to work, and own multiple other cars for when it breaks down.

$10k barely buys a reliable car in most markets these days.

There is no such thing as a $3k car,

Yes there is …

My 2009 honda fit cost me 5k 3 years ago and has needed no repairs at all… You can go lower pretty easily…

Used car markets are highly localized markets and depending on demand in the area can fluctuate wildly, just because you got a steal on a 14 year old car 3 years ago doesn’t mean other people aren’t struggling to find an affordable used car now.

I started at $1,400 in 2011. That went up to $3,200 by 2023 for the cheapest place in a worse part of town.

I had to move to an entirely different city. Fuck San Diego. Shitty ass city.

My last apartment was 1500 a month and I made a huge jump to buy a house with a 2500 a month mortgage. Seems crazy at first, but in 5 years that same shitty “luxury” apartment is going to cost at least 2800 a month.

I bought my house in 2014, $224k at 4% APR, my monthly payment including taxes is $1400/mo.

It’s only been 11 years, inflation is up ~35% in that time, so buying the same house now should be ~$1900/mo. Actual price if I were to buy it now? ~$3500/mo. And wages have barely budged. No wonder young people entering the workforce can’t buy houses anymore.

We bought a house in Tampa Florida area in 2018, our monthly cost was $1400/month. Moved to Washington in 2022 and bought a house and the house is smaller and our monthly payment is $3k. Area matters of course, but comparably I’d imagine we’re in similar situations.

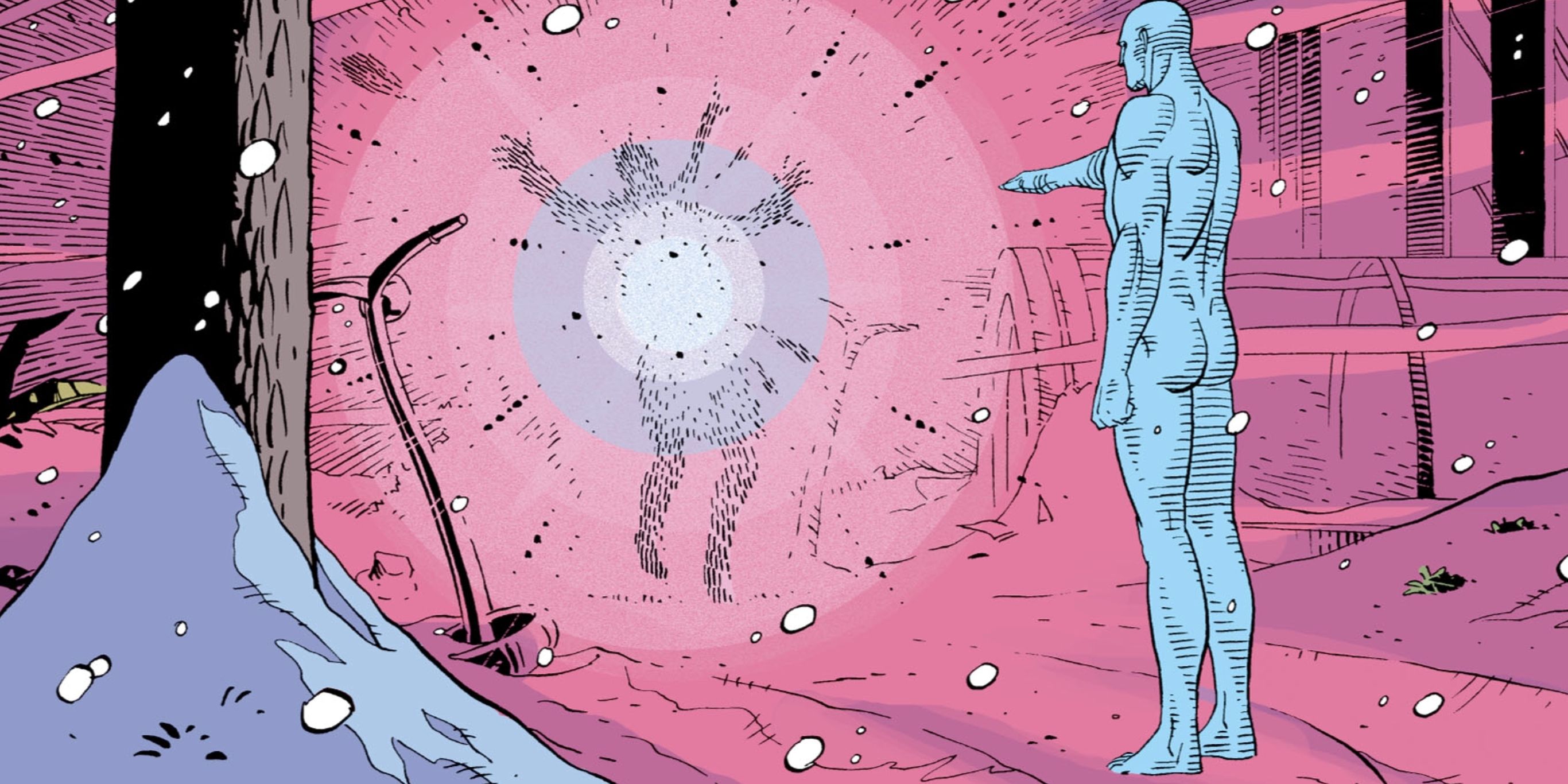

Is this the original unmodified drawing? What a dump truck on the lad.

Nope!

Right I remembered him fit, not deformed lol.

This is from the alternate reality where Rob Liefeld illustrated Watchmen

Nah, Doc has feet, couldn’t be liefeld

Somebody actually took the time and effort to make that adjustment.

Dr. Manhatten got back.

“Greedy landlords” is an easy cope out. Instead we should realize the system that’s built to continously inflate the economy whereas our wages stagnate at best.

Exactly. $400 for mine. $100 would fill a shopping cart with groceries back then. Health insurance: $80-125/mo. Internet: $15/mo. Garage sales almost everything was less than $10, most of it was less than $5. Goodwill was a deal. DIY/homemade was a deal, a way to save money.

It was a different time. There’s no equivalent to that time today, today is pretty awful.

And now it’s all going to be so much worse thanks to MAGA, oligarchs, and Heritage.

Pooooor Heritage Foo dation

Actually think their kids will be down to be obscenely rich in the future world where coral reef diving and backcountry skiing are only possible in VR

(I have to assume wealth and intelligence have a decent correlation sometimes, but Heritage proves the relationship is certainly not 1:1)

Yes, what is up with thrift stores charging almost the same as “first-hand” stores? Yet another example of how this generation is screwed (along with all of us old people).

Boutique thrift shops all try to act like they’re some amazing place to find funky retro fashion just waiting to be discovered on a Tiktok. It’s all overpriced. We’ve been to Goodwill and Habitat locally for stuff. Prices go from great to dirt cheap. They just want to move stuff, not hold on to someone’s idea of vintage cool.

Or they somehow want to price things off eBay prices. Bro, you are a thrift store. You aren’t some place that should be trying to get the absolute most out of an item.

Price it vaguely on what people might pay for some used, unwashed, beat to hell thing. If someone thinks they can get more by selling it online, that’s fine. That’s on them. You don’t have to compete with them. Turnover of items is more important than the most money on that old glass cup.

You used to be able to get grandpa’s old used golf clubs for $5/7 at goodwill and I put together a whole set for cheap. Moved and had to leave it behind now they put all the clubs straight online, you can’t even get them at the stores anymore. And the price is barely better than a newvset from Walmart. I wanna golf again :(

Video games are almost always ridiculous too. They’ll sell anything good online, and then charge like $10 for one of their 40 copies of Wii Fit.

The only good place to thrift nowadays is the small local places run by like churches. Goodwill sells shitty acrylic yarn for more than it costs new, wants $20+ for used kitchen appliances, sells current dollar tree shit for $5…

Goodwill fell off. It’s worth noting how the stuff we buy is basically worthless for resale the moment we buy it, since cheap new stuff is outcompeting it. It’s only value is use value.

Good news! Tariffs just made new stuff significantly more expensive so the resale value will be higher now. /s

Watching new vs used prices on things will be intresting

They do employ people who might not be able to get a job elsewhere, so not evil, just halfway shitty.

What the fuck? Thanks for making my day even worse I guess. Seriously thank you for the information, they will no longer get my business.

I know it’s a little off topic but eBay is a fucking scam as well… So many used items go for prices very close to brand new. I live in California, which charges VAT for ebay transactions. Add in shipping and I would be paying more than brand new for the vast majority of the inventory.

There are no good deals on ebay unless you spend a lot of time in bidding wars. You still risk getting a damaged item too…

Hey, at least they employ people who might not be able to get a job elsewhere. Goodwill does anyway.

Ive noticed this at chains, but not at my local stores. Goodwill for example, I always see dollar tree items marked as $2+. I know Theyre from dollar tree because theyre still in the damn package.

I found a neat looking board game at the thrift store once. I looked it up on my phone to check reviews, and learned it would be cheaper to buy it new than what they were asking. Usually they have good deals but not that time.

Walmart cut costs to the bone and squeezed down on what thrift stores used to charge.

Thrift stores are a deal compared to Macy’s, JC Penny, and such.

I blame macklemore.

Now playing MACKLEMORE & RYAN LEWIS - Thrift Shop

Agreed.

The only way for a wage earner to bootstrap their way up is to have money when historic opportunities to invest present themselves, like March 2020 and April 2025. If you have a few thousand to invest now, chances are that will turn into a massive profit over time. And even better, hold those securities for longer than a year and you get a preferred, lower tax rate on any profits.

But most people can’t do that. They’re stuck taking out an (air quotes) “interest-free” loan from Klarna to make sure they don’t starve this week. Our politicians are, thankfully, focused on the most important priorities, like drag queen story time. (And that’s sarcasm, btw.)

Please don’t invest right now. You are right that you can make a lot of money if you know what you’re doing, but it’s still a casino. With the people running the US right now, if they ever fully implement the tariffs, the market is going to eat shit. Then you can buy if there’s some glimmer of hope like Republicans losing Congress in 2026. I’m not trying to do US defaultism here, I believe this advice holds worldwide.

I pulled all my money out when Trump got elected, and that was a good choice. If I’d gone all in on options I’d be straight up hood rich, but I can’t gamble everything we have.

If the US collapses, the dollars you saved from pulling your investments is worthless…

That’s true, but so would the investments themselves.

Yes… But if the US doesn’t collapse then you make a lot of money buying the dip.

So either the US survives, and you make a lot of money if you invested, or the US crumbles and your cash or investments are both worth the same amount (zero).

I switched my retirement accounts to cash apprx feb 28, before the tariffs announcement and the market starting crashing. I just moved back into stocks this week. I’m convinced we’ve seen the worst of the tariffs… too many people are in trumps ear telling him he’s a retard. It’s only up from here.

Cluster B personality disorders don’t change their mind when called out, they double down. And interruption of the self constructed false reality makes them reactive.

I hope you’re correct for your benefit and the benefit of people who have retirement funds in the market.

I disagree however. Even if that fucking toddler-brained jackass backs completely off the tariffs (which I don’t think his ego will let him) he will do more heinous shit that will ruin the world economy in other ways. He’s also got several accelerationists in his ear that would love to see another great depression.

In less than 90 days the tariffs are back on, and the insane China ones are currently rolling I believe. Adidas put out a statement today saying the shoes are going to get a lot more expensive. Also, as of today, the oligarch Jeff Bezos is under federal investigation over a rumor that Amazon was going to tell customers what portion of the price of an item was due to tariffs. Just over a rumor. A rumor about a legal action that would be a smart business decision.

I’m keeping my money in the bank, and some in cash hidden in my home. Hopefully FDIC insurance still works.

Strongly agree. We’ve seen nothing yet and I think we’re going to see quarter after quarter of poor earnings and layoffs. Some empty shelves mid to late May. Housing crash at the end of this year or beginning of 2026. Hate to be somewhat doom and gloom but I’m also not going to miss this opportunity to jump back in with liquid. Good luck!

Yeah. We’ll see i suppose. The markets holding back a lot of suppressed upward mobility that we saw when the fake “tariffs are off” tweet happened. One whiff of good news will have us going up again.

In any case, at least I mitigated some of the damage. Can’t win 100% every time.

Just keep in mind the maxim- The market can remain irrational longer than you can remain solvent. It’s more of a vibes casino than it ever was before the GME stuff.

Even though I think you could be right, please don’t bet the barn. I don’t want to see you get hurt.

Ill be ok. Been 100% in a vtsax equivalent for 10 years… not retiring any time soon

Please, I’m begging you, please call Habitat for Humanity. Don’t make assumptions based on what you think you know about the program or have heard, just fucking call.

Worst case scenario: You spend an hour at the initial meeting and discover it won’t work for you. The other scenario: You end up owning a brand new home (or one refurbished to brand new) at cost.

Because my es-wife picked up the phone, I now own my own home at $600/mo., 19-year mortgage. Took us right at a year to complete the program and have keys in hand.

Be glad to answer questions, but there are variations according to the local outfit’s way of doing things.

I’ve thought about begging a similar outfit for that kind of help - I just got my first apartment on my own six or so months ago, and I’ve always been on the edge/dependent on others for help.

Do they ever help single people? I’d do anything just to have my name on a place. I’ve slept in a car before and I never want to be in that position again.

Perhaps you and a friend could pretend to be a couple? Doesn’t matter their gender or sexuality.

Oh uh hey, andros_rex, wanna go out? We can take a nice, romantic drive to a Habitat for Humanity’s interview.

She correct i worked making 6 bucks an hour in early 2001 and had my own apartment. Was 300 a month. Today fucking 1,000 for the same place. Bullshit not even close to what it should be.

My parents, 35000 dollars for a two bedroom, 1 bath house 3 acres of land in the middle of BFE back in the 80’s

Today, 3 bed, 1 bath house with less than .25 acres, 200k same BFE area.

With inflation something comparable to my parents house in BFE, because it’s not changed all that much, should only be 100k.

And the recent minimum wage increase to 13.75 an hour passed by the people is in process of being revoked by Republicans.

And I do get tired of visiting home and taking to people that spout off the ‘back in my day’ bs.

I see a lot of folks here saying “based on inflation since X, item Y SHOULD only cost Z.” I want to point out those inflation numbers the government gives out every year are complete bullshit. Inflation has been WAY more than 30% over the last decade and a half or so (not you but someone above mentioned 30% as the inflation number since the aughts)

They change their basket of goods to artificially deflate inflation numbers, it is way way way higher than the 2% a year that they claim is the average. Add greed on top and you get the crazy insane prices we see today. For a 2% inflation to really work for everyone and not just the rich assholes then minimum wage needs to increase proportionately. Should force minimum wage up the stated inflation rate once a year. So every year min wage increases by 2% (or more depending on the actual inflation rate).

BFE?

Acronym for being in the middle of nowhere.

“Bum Fuck Egypt” or some odd variant of that.

I’ve heard of “Butt Fuck Nowhere.” But never BFE or Egypt.

It’s been around a long time, at least since the ‘80s. You can now add it to your vocabulary.

Or not if noone knows what it means and it makes no sense.

It means out in the middle of nowhere. Most people know what it means, looks like it is just you here who doesn’t.

And you know the person that literally asked. And all the people that upvoted him. And if you look the comment saying he’s never heard of it has more upvotes than the comment saying it’s common. Brilliant analysis that it’s only me lol.

I don’t care, you do you. Nobody’s making you do anything. Plenty of people do know, so not like your lack of knowledge limits anyone else’s usage.

Sounds like “I enjoy being indecipherable, not my problem!”

Everyone said BFE and still says it, where I grew up.

Everybody I know knows what BFE is. Ask around.

It does make sense. It’s hyperbolically saying it’s so far away it might as well be in Egypt.

A lot of us in the Midwest say BFI, with I being Iowa. Think it has more to do with none of us wanting to be in Iowa.

the recent minimum wage increase to 13.75 an hour

Have higher standards

Seriously. I’m sick of this let’s-beg-for-an-itty-bitty-change nonsense. If rent near me is $2000/month, and that’s supposed to be 1/3 of my pay, then I should be making $6000 per month ($72k per year!)

Assuming I worked a full 40 hours every week, with 4 full weeks in a month, that means I’d need to make $1,500 per week, which breaks down to $37.50 per hour (before taxes, as well as before payments for employee benefits, garnishments, etc.)

I don’t live anywhere fancy. This place is an average apartment with too little parking and too many centipedes. Thankfully, I am not paying the entire rent by myself at this time, because I don’t make anywhere near $37.50/hour.

If $13.75 was the wage of somebody who worked a full 40 hours/week, for 4 weeks, they’d only make $2,200. Total. That’s it. For the entire month.

If your fight for a new minimum wage is starting with a number less than 30, you’ve already lost.

Saving money on food to buy a guillotine is personal finance.

Trade and barter with your fellow proletariat and create the tools.

Have tools, need wood.

Have wood, need hands. Sounds like we have a start!

Now kiss. Get your hands on their wood.

Wood for sheep?

We have scrapyards and bulk pickup. Reuse materials and save some dough

Maybe there is a financing plan in installments. Klarna or something…